Wyatt Capital has invested in office, industrial, raw land, retail, medical office and apartments assets and typically holds assets from 1-5 years. The average return on investment for the six Wyatt Capital assets acquired and exited between 2009-2015 equaled 81.67% annualized which included retail, office, raw land, medical office and apartment assets. Current assets owned by Wyatt Capital include urban industrial, office, and raw land. Wyatt Capital maintains relationships with other real estate operators who periodically partner with Wyatt Capital to co-operate its investments when the asset strategy warrants such.

Venture Center – Medical Office Building Sale

An affiliate entity of Wyatt Capital sold this 40,000 square foot medical office asset to MB Real Estate Investors based in Chicago, IL in December 2014 for $6.3MM.

An affiliate entity of Wyatt Capital sold this 40,000 square foot medical office asset to MB Real Estate Investors based in Chicago, IL in December 2014 for $6.3MM.

Wyatt acquired this asset for $3.1MM in December 2012 from a regional lender who had previously foreclosed on the asset. The property was less than 50% occupied at acquisition although Children’s Healthcare of Atlanta (“CHOA”) had committed to lease the balance of the vacant space in the building as of closing.

During the 2 year hold period for this investment, Wyatt addressed numerous deferred maintenance items including replacement of the cooling tower, various other HVAC improvements, roof repairs, parking lot resurfacing, etc. Additionally, CHOA restructured its lease to extend its term and secure its longer term tenancy at this location at a favorable lease rate.

Total return on equity for the holding period of this asset exceeded 400%.

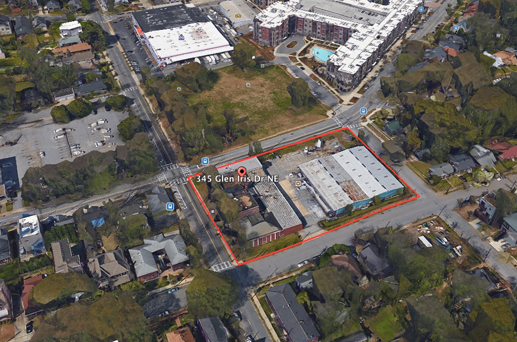

345 Glen Iris Drive

The site is an entire city block that was improved with two warehouse buildings near the Atlanta Beltline & Ponce City Market in Old 4th Ward.

A Wyatt Capital affiliate entity acquired 1.9 acres in the Old 4th Ward in April 2013 from an owner occupant who leased back 100% of the property for 18 months. The site was an entire city block that is improved with two warehouse buildings totaling 32,000 square feet and is in very close proximity to the popular Atlanta Beltline, Ponce City Market, and the Old 4th Ward public park. The investment thesis was supported by the favorable land basis, redevelopment potential for the site, the credit leaseback structure during the hold period, and rapidly improving demographics occurring in this “in town” market.

A Wyatt Capital affiliate entity acquired 1.9 acres in the Old 4th Ward in April 2013 from an owner occupant who leased back 100% of the property for 18 months. The site was an entire city block that is improved with two warehouse buildings totaling 32,000 square feet and is in very close proximity to the popular Atlanta Beltline, Ponce City Market, and the Old 4th Ward public park. The investment thesis was supported by the favorable land basis, redevelopment potential for the site, the credit leaseback structure during the hold period, and rapidly improving demographics occurring in this “in town” market.

After a hold period of 18 months, the asset was sold in November 2014 to a national home-builder for a residential development project on the site. The sale provided a total return to Wyatt Capital limited partner investors of approximately 147%.

Defoors Crossing Apartments

A 60 unit apartment complex in Buckhead

An affiliate of Wyatt Capital acquired this 60 unit apartment asset in August 2010 from one of the largest apartment REIT’s in the U.S., AIMCO, for $3 Million. The asset was constructed in 1987 and is located on 1.486 acres in a superior neighborhood and location in Buckhead. The investment was made due to a motivated seller and the potential for increase in renter and investor demand for this asset class; especially for “in town” locations. Wyatt refinanced the asset in July 2012 at a higher valuation and lowered its debt service obligation during a historically low interest rate environment. The asset remained virtually 100% occupied since acquisition.

An affiliate of Wyatt Capital acquired this 60 unit apartment asset in August 2010 from one of the largest apartment REIT’s in the U.S., AIMCO, for $3 Million. The asset was constructed in 1987 and is located on 1.486 acres in a superior neighborhood and location in Buckhead. The investment was made due to a motivated seller and the potential for increase in renter and investor demand for this asset class; especially for “in town” locations. Wyatt refinanced the asset in July 2012 at a higher valuation and lowered its debt service obligation during a historically low interest rate environment. The asset remained virtually 100% occupied since acquisition.

The asset was sold in September 2014 for $4.6 Million. The overall investment provided an annualized return of better than 40% to the investors.

Buckhead Land Investment

DEFOORS FERRY ROAD LAND ASSEMBLAGE INVESTMENT

DEFOORS FERRY ROAD LAND ASSEMBLAGE INVESTMENT

An affiliate entity of Wyatt Capital, LLC (“Wyatt”) assembled four parcels totaling approximately 1.76 acres in three separate transactions between 2006 and 2008. The site is located between Midtown and Buckhead in the southern portion of the Buckhead submarket in a neighborhood commercial corridor in the Morris Brandon School district. The first two parcels were acquired in 2006 from the Piedmont Hospital Foundation and included a functionally obsolete structure formerly occupied by a day care center (that was subsequently demolished after the acquisition) on approximately 1.15 acres. The third and fourth contiguous parcels totaled .61 acres were acquired separately from two individual owners and included a raw vacant piece of land and one residential structure on the site. The entire site was designated for low density commercial development by the City of Atlanta’s long term land use plan which provided flexibility on what the site could be developed as which provided for many options when considering an exit of the investment. A residential townhome developer rezoned and acquired the site from Wyatt in August, 2013. This investment is a good example of Wyatt’s defensive underwriting practices and discipline given that the site was acquired at the peak of the market yet still provided a very satisfactory double digit return (annualized) to ownership.

South Carolina Retail Investment

Retail Real Estate Investment

Retail Real Estate Investment

Charleston, South Carolina

Wyatt Capital Flips 2,300 Square Foot Former Bank Branch to a Local 1031 Investor

Wyatt Capital assigned its contract and closed in February 2013 on a 2,300 square foot former bank branch formerly owned and occupied by Heritage Trust Credit Union. The property was placed under contract by Wyatt Capital in late November 2012 along with an extended due diligence period and a motivated investor purchased the property at a 1.23 x multiple above Wyatt’s contract price. The property is located in Mt. Pleasant, South Carolina with frontage on Highway 17 and south of the intersection of I-526 and Hwy. 17. The property is in a high traffic retail and hospital corridor with great access and visibility. Wyatt Capital was attracted to the real estate due to being able to purchase the property “off market”, the active real estate market in Mt. Pleasant, and having an extended period for due diligence. Wyatt Capital had no capital at risk during this transaction.

Boutique Office – 460 East Paces Ferry Road

BOUTIQUE OFFICE BUILDING ACQUISITION AND RENOVATION

BOUTIQUE OFFICE BUILDING ACQUISITION AND RENOVATION

458 & 460 East Paces Ferry Road, Atlanta, Georgia

BUCKHEAD

Affiliates of Wyatt Capital, LLC acquired 2 distressed office buildings in Buckhead located at 458 & 460 East Paces Ferry Road in late 2012. The 460 unit had been foreclosed on by a lender and was acquired at a substantial discount while the 458 was also acquired at a depressed valuation from an estate seller. Both buildings are fee simple ownership and involved a total renovation by Wyatt of the interior and exterior which included new roof, HVAC replacement, completely new interiors, new CAT5 wiring and cabling throughout, new hardwood floors, cabinetry, plumbing, and new lighting throughout both buildings. 458 was subsequently partially leased and subsequently sold to an owner occupant 14 months after initial acquisition and provided an exceptional return of better than 70% to Wyatt Capital’s investment partner. Wyatt Capital relocated its offices into 460 East Paces Ferry Road.

PINE HILLS APARTMENTS – 48 Unit apartment renovation

SMYRNA, GEORGIA

Wyatt Capital affiliates acquired a 48 unit Class C apartment asset in September 2012 and promptly commenced a renovation of the entire property which concluded in spring 2013. The investment was made due to the ability to acquire a “broken” asset at a favorable price in a great Cobb county neighborhood location with excellent access. Dynamics in this market supported a multi-family investment given that supply was decreasing due to local municipality decisions to acquire and demolish multi-family assets and further prohibit entitlement of sites for new multi-family construction resulting in a substantial supply/demand imbalance. Wyatt’s team acquired, renovated, leased, and then sold the asset to an out of state investor in November 2013 after a 15 month hold period at a 69% return to Wyatt Capital and its investment partners

Wyatt Capital affiliates acquired a 48 unit Class C apartment asset in September 2012 and promptly commenced a renovation of the entire property which concluded in spring 2013. The investment was made due to the ability to acquire a “broken” asset at a favorable price in a great Cobb county neighborhood location with excellent access. Dynamics in this market supported a multi-family investment given that supply was decreasing due to local municipality decisions to acquire and demolish multi-family assets and further prohibit entitlement of sites for new multi-family construction resulting in a substantial supply/demand imbalance. Wyatt’s team acquired, renovated, leased, and then sold the asset to an out of state investor in November 2013 after a 15 month hold period at a 69% return to Wyatt Capital and its investment partners