Letter to Our Limited Partners — 2024

“In the old legend, the wise men finally boiled down the history of mortal affairs into the single phrase, “This too shall pass”. Confronted with a like challenge to distill the secret of sound investment into three words, we venture the motto, “MARGIN OF SAFETY”. “

-Benjamin Graham, The Intelligent Investor, 1949

March 18th, 2024

Dear Limited Partners,

I’ll start this year’s letter as I typically do- with a gracious thank you for being partners given your previous investments made jointly with Wyatt Capital (“WC”) and for your continued interest in any potential partnerships in future opportunities. I’m very appreciative of your ongoing interest in potential investments together and in my annual perspective on the commercial real estate asset class.

Since the inception of WC in April of 2007, a strict adherence to a disciplined investing process has resulted in very favorable returns for every investment made and has served to keep us all out of trouble – and I have no intention of altering this approach. It’s best to stick with methods that have proven to be successful and to remain disciplined no matter how long it takes for market conditions to adjust such that a significant margin of safety on new investments may be realized. Although there is a lot of ambitious capital and “dry powder” poised on the sidelines and ready to allocate into what the market perceives will be significant investment opportunity, there has been little in the way of any mass wave of heavily discounted distressed asset’s coming to market to date. Although the market is beginning to show some signs of loosening up a bit with some credit formation beginning to slowly take place, some foreclosure activity occurring, and the pace of dealmaking increasing, it’s likely to continue to generally be slow going. If the stock market is a speed boat that adjusts rapidly from moment to moment and with instantaneous liquidity, the CRE market is an illiquid battleship that requires a lot of time to turn in any direction. Knowing where one is in the cycle is of paramount importance for proper investing decision making and for knowing when to buy, when to sell, and when to do nothing. Many historically wise investors with vast experience suggest that when it comes to investing, doing nothing is frequently both the best thing to do (and one of the hardest things to do). Doing nothing is hard, but putting capital at risk when you shouldn’t causes greater pain.

As is obvious at this point, I’ve sequestered myself to the sidelines in recent years while having not made any new commercial real estate (“CRE”) investments since our last acquisition in early Q4 of 2018 of a 30% occupied Class A office building (3333 Riverwood Parkway – which was subsequently leased to 99% occupancy and very favorably sold in 2021). I’m humbly thankful for WC’s pristine track record of performance as your General Partner and, although I am hesitant in several ways to verbalize it, there are many reasons (some controllable and others not) that WC has yielded favorable returns on every CRE investment made since inception (average annual project level returns across the WC portfolio to date = 59%) and, so far, successfully avoided any capital impairment. I must include the words “so far” as a big caveat given that a practical application of reasonable odds and a bit of nuanced superstition will not allow me to make that statement otherwise given that the future is both unknowable and unpredictable and that simple good fortune is a part of any successful investor’s story (which has most certainly been the circumstance in my case). The legendary investor Sir John Templeton suggests that the best time to buy is when there is maximum pessimism. With perhaps the exception of certain office assets, we are far from maximum pessimism today as it relates to most asset values. If I believe there are better places than CRE for your equity and mine like I have in recent years, why would I behave otherwise and encourage any CRE capital allocations?

Time horizon and risk profile are always major variables in every investment decision. What makes sense for one investor doesn’t make sense for another. WC has been a pure seller of CRE assets since mid-2018 and chose not to reallocate into any new investments in the latter part of this cycle due to the distorted state of the capital markets and the frothy asset valuations that required taking on risks that were unappealing and while utilizing drastically low cost of debt levels that were unsustainable. Even if a low cost of debt was locked in at a fixed rate at the interest rate trough while providing for acceptable yields on equity, holding periods for these assets in many cases have now been extended beyond initial assumptions given how the cost of debt (now higher) has devalued these assets while rental rate growth assumptions become questionable or unattainable. At best, this generally means investor equity is locked up for longer and at lower returns than assumed and, at worst, capital impairment is possible subject to economic conditions, leasing performance, and debt maturity risks.

The responsibility of placing a client’s precious capital is something I take very seriously and have always treated client capital as if it were my own. It is my personal philosophy that just because one has access to capital does not necessarily mean that one should take on the obligations, responsibilities, and risks of putting that capital to work- and especially in an environment where the downside risks for the majority of CRE equity positions have recently far exceeded any moderate upside potential for most assets. Although market conditions are shifting, the lingering effects of market distortion due to the pandemic have influenced the CRE market significantly and the road ahead is likely to be bumpy near term while some “broken” investments must be unwound and values get reset. It simply takes time for conditions to adjust with such illiquid assets. Many operators continue to raise and place capital simply because they can and/or due to the management fee opportunities. Wyatt Capital does not. Having a very limited expense overhead affords the luxury of maintaining an investment discipline that dictates when and where capital gets placed without undue influence from any potential management fees. A new investment will simply not be made unless there’s appropriate risk adjusted returns available for all equity investors and not until a clear margin of safety is available to accommodate for both known and unknown downside risks. During the first three years of WC’s existence from early 2007 thru 2009, only one very small raw land parcel was acquired (to finalize a land assemblage that was already previously underway) – this lone transaction was the only acquisition WC made during that time period despite aggressively and continuously shopping and underwriting and offering on hundreds of different assets during a market dynamic of declining asset values during the emerging financial crisis. When answering questions in random conversations about my career and upon disclosing that I launched a CRE investment company early in 2007 (just prior to the subprime meltdown and subsequent financial crisis), this news, both then and now, was regularly reacted to with commentary such as “how unfortunate timing!” and other similar sentiments. In truth, it was by far the best thing that could have ever happened as I was blessed with spending 3 years learning needed lessons in the underwriting, valuation, capital raising, and risk management assessment processes. Despite not making any acquisitions, I gained a wealth of experience and clarity with how to consider a CRE investment. By 2010, asset valueshad fallen far enough and reasonably enough to transact broadly and by then, I was ready. Sometimes, at least in this game anyway, it’s simply not the time to buy – and this has again been the case in recent years. Some might label this as trying to time the market and others may characterize it as waiting to transact until pricing can be arranged at an appropriate basis at better than intrinsic asset value. I prefer to view this investment approach through the latter lens. WC prefers to generally hold CRE for only 1-5 years, create value within that time frame, and then exit. Given the nature of this preferred investment model, any entry basis must include a clear margin of safety for the investment to meet appropriate return parameters. Conditions simply must be right for this model to function properly.

In my February 2020 investor letter (written immediately prior to the onset of the Covid pandemic), I wrote:

“While there are always inefficiencies in any real estate market that will allow for certain rifle shot investments to be made in specific cases……..generally speaking, I expect those opportunities to be difficult to locate in current market conditions. In short, there’s too much capital chasing too few opportunities resulting in overpriced assets that don’t properly reflect the risk being incurred. I expect this will end badly for some new capital entering this market at today’s pricing when the tide eventually goes out but have no idea when such a market correction may occur.”

The tide is now well on its way out and we are in the early innings of a challenging process for some CRE borrowers as values reset and some capital losses must eventually be dealt with. This is particularly the case for investors who bought between 2018 and early 2022 and utilized short term or floating rate debt. Specifically, both the timing of when capital losses will be realized, and the depth of these losses, remains opaque. How many assets will find their way into the lender’s hands is unclear as few have so far. There was substantial borrower equity put at risk at previous asset values that could be partially salvaged if given time and all parties are motivated to extend loans and hope for future recovery vs. absorbing capital losses today. Investors hoping for a mass wave of foreclosed CRE assets to shop over may be disappointed with how this downcycle plays out. Whether we will see substantial foreclosure activity or substantial recapitalization activity or a combination of these two scenarios, 2024 appears to be the beginning of a time of reckoning for some CRE owners. The lenders have the leverage over the borrowers today given a very tight and costly lending market. For those lenders that have the reserves to handle it, some may desire to force an asset sale to retrieve and recycle their maturing debt capital into alternative investment options if favorable debt renewal terms cannot be achieved with their borrower. There is little relief in sight for those borrowers who don’t have the balance sheets or ability to find fresh equity to recapitalize assets in this more expensive capital market (although if a loan is still performing and relatively “healthy”, a loan extension remains a potential short-term path forward for both parties without additional equity near term).

In last year’s letter, I wrote about a “Return to Fundamentals” for CRE investors and this shift is still very much underway as new capital waits for both prices to correct and contemplates how to play this market. Double digit declines in deal volume across all asset types became the norm in the past year as higher borrowing costs and unrealistic pricing expectations by sellers stymied transactions. In more basic verbiage, the CRE investment market has simply been stuck. Even multifamily and industrial, long viewed as the most stable safe havens in the CRE asset class, saw late year transaction volumes fall by 68% and 64% respectively. It’s simply hard to do deals when the math doesn’t work. Some things have changed in the last 12 months while a lot has not.

WHAT’S NOT NEW? DEBT MATURITIES………

“It’s often said that the worst of loans are made during the best of times.”

– Howard Marks

What’s not new is the wall of debt maturities that CRE borrowers are facing today which is now estimated to be north of $900 Billion in 2024; partly because of numerous loan extensions occurring in 2023. The CRE universe is constructed on big loans and with the assumption being those loans can get reasonably refinanced with little friction every few years. Today’s debt market is far from frictionless. It’s fair to say that in periods of easy money where capital is plentiful, even some of the weakest borrowers have access to capital, in large amounts, and for almost any purpose. Deals that ordinarily wouldn’t be financed during times of tighter capital, become acceptable. The amount of debt now scheduled to come due this year represents approximately 20% of the entire CRE debt market (which is estimated to total $4.7 Trillion today). Approximately one third of these maturing loans were extended from 2023 maturity dates and undoubtedly there will be many loans extended in 2024 also. Even if the asset value is lower than it used to be, it’s not hard to extend a loan when the borrower is performing and yielding good revenue for a lender where the only new circumstance is a lower debt service coverage ratio. Compared to aggravating a customer and/or forcing a sale and creating capital losses, an extension on a loan that is meeting debt service payments is an easy decision for any lender even if the debt service coverage is tighter than it previously was. However, some loans won’t be extended, and it’s expected that the day of reckoning will certainly arrive for those borrowers with nonperforming loans who need fresh capital but don’t have access to it this year. Approximately half of the maturing debt in 2024 is in multifamily (27%) and office (22%) combined, followed by industrial (12%), hotel (12%), and then retail (8%). Banks hold approximately 47% of the loans set to mature this year. The private credit market is huge now and estimated to be at approximately $1.7 Trillion today. This market is very opaque and any stresses there are not broadly visible in the marketplace; and wherever there is a lack of transparency, there is typically increased risk. Although we know there are challenges with private credit loan portfolios, those lenders tend to be more nimble, creative, and entrepreneurial compared to traditional bank lenders and are more likely to manage any asset challenges to a more successful conclusion thanthe typical bank given the lack of regulatory oversight in the private credit market which offers private lenders more optionality.

Loan delinquencies are growing – the 30-day delinquency rate for office CMBS loans surged from 1.6% at end of 2022 to 6.3% in January of 2024; and this is just the beginning as the issues with office demand are secular in nature, not cyclical. Near term, the typical office tenant can probably be expected to take 30%-ish less space on average upon lease expirations or perhaps a bit more as tenants can always come back and expand later if needed- this is a problem for most of the office market from a demand perspective. There are likely more tenants who will downsize at lease expiration in the next 12-24 months than will keep their existing space or expand as employers cooperate with the Work From Home (“WFH”) desires of their workforce and especially in congested cities with habitual traffic problems- this also does not bode well for the urban downtown markets that are dependent on office workers and business travel to support surrounding real estate assets such as urban retail – this situation is collectively being referred to as the “urban doom loop”. Whether trouble with office debt ends in a simple pricing correction or becomes a larger crisis for banks and cities, more pain is coming. When you have a situation where real estate assets incur rising vacancies and asset values are falling precipitously, property taxes on those assets will fall significantly which affects local governments by having less money to go around to sustain and provide needed local services. This bleeds into residents’ psychology who relocate due to deteriorating quality of urban life – this is already happening today as the 10 largest cities in the U.S. have lost 2 million residents in the last 3 years (which further lowers the tax base).

Frankly, and other than expectations for potential interest rate cuts, there have been very few significantly new dynamics in capital market conditions in the last year and, although the market is beginning to loosen up a little bit today, not a lot has changed valuation wise in the current state of the CRE markets with few trades available to measure market value by; but we know that CRE assets are generally not worth what many owners and lenders hope they are. Approximately $324 Billion of CRE traded hands in 2023 which was a 55% decrease from 2022. Other than a few office asset foreclosures that had long been struggling, loan extensions have served to kick the can down the road and delay the pain for all participants. We are another year further into the higher interest rate environment now and there’s continuous pressure on both lenders and borrowers today as the valuation realities slowly get recognized for assets with maturing debt. Certain lenders will inevitably want to recover some of their debt capital and redeploy it into more liquid assets at higher rates (bonds) and this poses a problem for weak borrowers who don’t have the financial strength to solve for what lenders may require today to extend loans. The best acquisition opportunities for equity investors will undoubtedly be to acquire foreclosed assets from banks and after they’ve been written down accordingly- how long it will take for the lending community to reach their breaking point and begin seizing collateral assets and then how long it will take for lenders to price those assets reasonably is unclear. It’s unlikely to be a quick process if lender and regulator behavior from the financial crisis of 2008 is any indicator of their future behavior.

Oh, and the overall economy has been performing well despite drastically higher interest rates and with a soaring equities market and almost record low unemployment. I wonder what will happen with CRE values when the economy eventually finds its way into the ditch and/or there’s contraction of any economically supportive government spending? Will future interest rate reductions save CRE asset values from deterioration in a future recession? I recommend strategic planning for any CRE asset challenges that involves more than just hope.

WHAT’S NEW?

“The great paradox of this remarkable age is that the more complex the world around us becomes, the more simplicity we must seek in order to realize our financial goals…….Simplicity, indeed, is the master key to financial success.”

– Jack Bogle

What is new in the last 12 months is substantially lower inflation, the emergence of Artificial Intelligence (“AI”), war has broken out in the Middle East again, the recession that many “experts” predicted never occurred, and it’s an election year (and a rather unusual one at that). For investors, CRE investing conditions are improving today and, although it’s still early and remains a very slow-moving process, investment prospects are better than they were a year ago given the relative downward pressure on CRE asset values and the inevitable recognition that CRE assets aren’t worth what they used to be. Whether asset values are going to fall to a place that attracts WC off the sidelines or not remains to be seen but the return potential is going to have to improve considerably to lure me back into taking CRE risk. Today, while time is generally on the side of the buyers, there is a lot of capital out there waiting to pounce when asset values fall far enough to justify entry- but it’s been a slow developing process and will continue to be. If there’s a great abundance of new capital poised for deployment, and a large population of investors with that capital see this as a generational investment opportunity, then how will a crowded playing field realize this generational investment opportunity? I don’t know, but it sounds rather competitive. Although it’s certainly accurate to say that there’s less “dumb money” in the streets playing today compared to 3 years ago, there is more capital available for CRE purposes today than ever before and with dry powder levels being reported to be over $400 Billion globally with $250 Billion of that amount targeted for U.S. investments. There is some probability that this significant amount of liquidity looking for CRE investment coupled with the pressure to place this capital within a defined time frame will buoy asset pricing in this downcycle which will ultimately result in lower returns for investors. This is virtually always the case when there’s excessive capital competition.

Recently, I observed a transaction that traded near the southeast corner of Central Park in Manhattan at 5 East 59th St. This 45,000 sf 9 story office/retail building is only a stone’s throw from the Apple Store and traded for $26 MM last month to a future owner/occupant- and this after previously trading for $85 MM almost 9 years ago. Yes, the NYC CRE market has its unique challenges today but it’s likely that this purchaser has just made a wonderful capital allocation if he can hold the asset long enough for values to recover- and although when values will recover is unknown, they likely will improve over time and especially if local governments start enforcing laws and policing crime more stringently. The Atlanta market conditions are quite different from Manhattan as such bargain basement deals are not yet widely available here today.

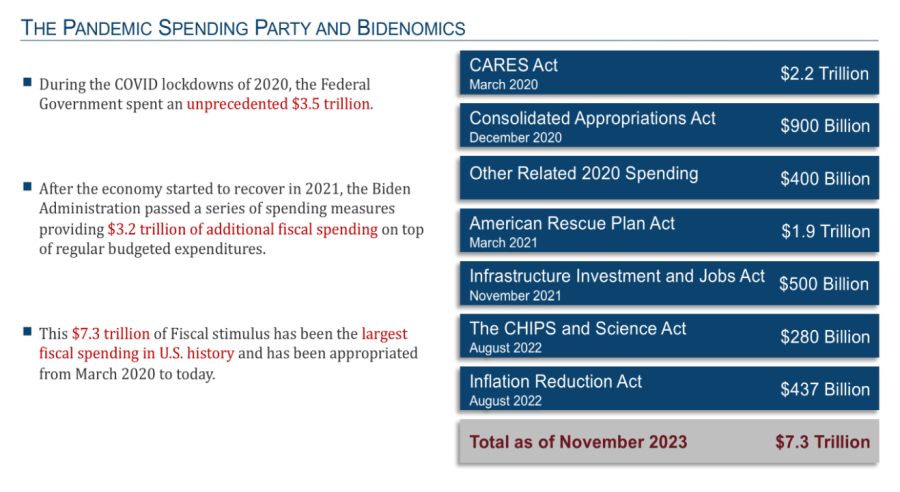

In essence, the Fed’s monetary policy efforts are at odds with our government’s fiscal policy with the Fed effectively slamming on the brakes while Congress steps on the gas. It remains to be seen what the long- term effects (both positive and negative) of this fiscal spending will produce, but for now, it’s helped sustain the economy while the Fed gets inflation more under control – which some would argue is a remarkable near-term result given how abruptly and substantially interest rates have been increased. Regardless of the why and how these circumstances have unfolded, the battle against inflation has been well handled by the Fed so far (at least so if measured by the current inflation rate and current economic and market conditions) while the overriding message for market participants today remains that capital is not going to be “free” anymore. Today, the Fed appears to be in no hurry to cut rates despite encouragement from some in the risk asset markets that encourage otherwise and while I don’t believe in forecasting, I do anticipate that Fed will err on keeping rates higher for longer near term and will be more comfortable to risk breaking something in the economy before they will risk cutting rates too early and risk more inflationary pressures. If this expectation is correct, then there is no near-term capital relief in sight for the borrowers of the billions in maturing CRE debt scheduled for this year.

The Fed has lowered interest rates only five times in the past 90 years in stretches when core CPI was growing faster than the unemployment rate. With core CPI up 3.9% through January, a rate cut would rank among those rare instances given the current 3.7% jobless rate. Planning for a decrease in interest rates anytime soon and in any relevant manner appears to be a fool’s errand given the data that’s visible and available today. Furthermore, any mild reduction in interest rates that may occur isn’t likely to solve many of the problems with CRE asset balance sheets today. And the clock is ticking…….

What else is new is the expanding distress for over leveraged CRE assets with office leading the way showing more than $32 Billion in distressed loans and another $50 Billion at risk of becoming distressed in 2024 and with few borrowers motivated to throw good money after bad given the secular change in office demand. In Atlanta, office vacancies are now at approximately 30% and still growing. In multifamily, there are nearly 1 million apartment units under construction nationally with 670,000 units set to deliver in 2024 with Nashville, Austin, Dallas, and Atlanta amongst the cities adding the most new inventory. Approximately 440,000 new multifamily units were delivered in 2023. The multifamily sector had $7.5 Billion in outstanding distressed debt as of 3rd quarter 2023 with another $65 Billion in potential distress looming according to MCSI – and this despite that Fannie and Freddie have available capital to lend and at lower rates than most traditional lenders are offering. This debt problem today speaks to how low interest rates were and how much higher interest rates today affect assets that were underwritten and acquired during the free money era – with debt at a cost of 3.5% all was OK, but all is not well when debt rates were assumed to stay low but now cost 6.5%+ and higher. Coupled with higher debt costs are falling rental rates in some markets which only exacerbates multifamily’ s problems. Average rents in Atlanta fell 3.3% in Q3 2023 and this dip in rental rates coincided with pending mass delivery of new supply.

Other new challenges for some CRE assets in certain geographies are rising expenses – and specifically insurance expense increases being a glaring example. Property insurance rates for properties near the coast are expected to rise between 10% to 25% in 2024 after already increasing rapidly in the previous 18 months. As natural disasters increase in frequency and severity, coupled with the recent upward spiral of construction costs and with some insurance companies managing risk by completely exiting some markets like Florida, there’s only one direction the cost of insurance is going near term as competition shrinks. The Urban Land Institute indicated in October 2023 that the insurance expense increases are reaching “crisis levels” and these increases are not easily passed onto tenants who are already paying exorbitantly high rental rates. Even less exposed properties in less risky geographies are seeing insurance increases by as much as 10%+ year over year. Additionally, renter fraud is a growing problem in multifamily with the eviction process being typically slow in many municipalities which serves to support the fraudster occupancy model resulting in more operational headaches for owners. While the fundamental mid to longer term story in multifamily appears solid due to limited housing supply in general, lack of new funding today for new development projects, and lack of affordable homes to purchase, the short term is quite challenging for this asset class. Given that most existing projects are cash flowing nicely due to lack of available housing options overall and given the amount of capital chasing multifamily, this asset class is ripe for recapitalization of existing assets with fresh capital finding weak owners to partner with as mass foreclosure activity in multifamily isn’t likely.

ARTIFICIAL INTELLIGENCE

It’s clear that the U.S. is the world leader in AI today and the arms race is on.A/I advancements are certainly new and evolving rapidly in the past year with notable stock appreciation in some well positioned companies (Nvidia up more than 300% in last 14 months as of this writing) whose shareholders are profiting handsomely so far from the race amongst the top technology companies to establish their foothold in this rapidly emerging area of technology. Data Center REIT shares rose 30% on average in 2023. Digital Realty Trust (DLR) is a standout performer amongst the data center REIT’s having expanded its Funds from Operations at an annual average of 11% since its founding in 2004. It’s little wonder the stock has performed well recently and is up approximately 40% + since the beginning of 2023 although I cannot say with confidence that it’s good value today as there are potential bubble characteristics with almost everything AI currently. From a real estate demand perspective, the most visible and immediate impact of AI growth is with demand for more data center space (which I commented on as an intriguing asset class for new investment in last year’s investor letter). I asked the AI chatbot ChatGPT, “How will AI effect demand for data center space?”. It’s answer?

“AI is expected to significantly impact the demand for data center space due to its intensive computational requirements. As AI algorithms become more sophisticated and data-intensive, organizations will require larger and more powerful data centers to support their AI workloads. This increased demand for computational resources will likely drive the expansion of existing data centers and the construction of new ones to accommodate the growing needs of AI applications. Additionally, advancements in AI technologies may lead to the development of specialized data centers optimized for AI workloads, further shaping the data center landscape.”

Frankly, I’m not that impressed with this response given its generalist nature and with no specificity offered. A more impressive response would have addressed growing data center demand within the potential hurdles and limitations to providing new supply including:

- Available power capacity given AI’s significantly greater power consumption needs than traditional data centers have previously offered.

- Modified cooling technology needs with liquid cooled methods preferred for AI over the limitations of air-cooled chillers.

- How water constraints in some drought markets such as Arizona and Southern California could adversely impact data center development due to water scarcity and future cooling requirements.

Current data centers generally offer approximately 50 megawatts of power per facility today while future data centers could feasibly need to support up to 4 X that power capacity within the same physical space – and this upgrade will not be inexpensive. How data centers are tasked and allocated for AI specifically is not transparent due to confidentiality of this developing technology amongst market participants and given how little detailed data is publicly available; but the risk of infrastructure obsolescence and rising energy prices and grid infrastructure capacity will be something to watch as data centers attempt to manage increasing operating expenses and maintain their current profitability. In short, it’s very likely going to cost A LOT more in developing and operating data centers and be a more substantial drag on our power and water resources. It’s a very capital-intensive business to acquire and develop data center assets and there are some indications of a potential shortage of capital in the space. Demand by AI, the Cloud, and digitization of the economy all contribute to more data center demand – and today there’s a 2% vacancy rate and rent growth is spiking. With AI essentially still in relative infancy, the major technology companies are racing to compete by collectively investing $1 Trillion into their infrastructure that will support AI advancements. Those investors with scale capital, relationships with the large data center users, and land assets with access to power, are poised to be the winners. Blackstone is a major player in the data center space having bought QTS in 2021 for $10 Billion, taken them private, and grown the business sixfold since acquisition. Blackstone also is sitting on $65 Billion of dry powder and is ready to deploy. It’s clear that demand for data management is only growing. What’s unclear is whether our electrical grid and power capacity can keep up and how data center operations conflict with current and future climate policies which could affect new development.

NATIONAL DEBT

“He that goes a borrowing, goes a sorrowing.”

– Benjamin Franklin

With our national debt load now at $34.5 Trillion, this is a big and rapidly growing number that our politicians don’t seem to be taking as seriously as they should given how quickly this debt amount is expanding while effectively approaching 1.3 times GDP. The U.S. is on a perilous course while barreling towards a financial cliff. Some suggest this debt concern has been in place for decades and for generations and has yet to materialize into an unmanageable problem, so why worry now? My response to that would be that as of 2008, home prices had never gone down before either. To believe that excessive debt can’t cause a potential future calamity is extremely naive. Growth in revenue is needed as is reducing expenses, or at least holding costs steady – a scenario that seems completely unlikely near term. Ultimately, this level of debt is a drag on the economy at best – the interest on our debt in February of 2024 was $76 Billion which was a 67% increase in debt interest expense from one year ago. Have you heard much about Modern Monetary Theory recently? I haven’t. It’s now hopefully apparent to our central banks and the Fed (and everyone else) how foolish of a notion that naive theory is. Both M1 and M2 are contracting today with M1 down 9.6% year over year and M2 down 3% with the Fed’s balance sheet shrinking by $842 Billion to a total of $7.74 Trillion as of January 2024 (although there remains excess liquidity in the financial system). The deficit is estimated by the CBO to rise to $1.57 Trillion this year and $1.76 Trillion next year which is running at an unsustainable rate of approximately 6% of GDP.Also, history shows us that the debt to GDP ratio tends to rise during recessions and in their aftermath. GDP shrinks during a recession while government tax receipts decline and safety net spending rises. The combination of higher budget deficits with lower GDP inflates the ratio.

Long-term interest rates typically follow inflation. This assumption may not occur this time due to the debt levels the US is facing and the risk that a potentially shrinking group of capable and sizable buyers are going to require higher rates to fund our debt. If so, then those consequences will only make the drag of our debt service more economically consequential than otherwise while any steepening of the yield curve should benefit the banks given their business model of borrowing short and lending long.

In the context of how government debt and inflation affect the CRE market, there is likelihood that interest rates will stay higher in the near term due to both circumstances. If the U.S. debt problem is considered more risky than less risky by the capital markets, higher interest rates will be required to sell our debt. Also, if there are fewer buyers of our debt in the marketplace, that would also warrant likely higher interest rates to successfully transact a debt sale. Inflation, of course, can typically be dealt with by higher short-term interest rates that will directly slow down the pace of credit formation and capital flows. These scenarios tend to put more downward pressure on CRE assets than otherwise due to simple cost of capital and having alternate investment options with superior yield and credit characteristics. For those of you out there putting capital to work in CRE today, it’s early and please be careful. Of course, It’s always possible the CRE markets could take off and run substantially higher from here, but I wouldn’t bet on it.

WHERE TO INVEST TODAY?

“Sometimes there are plentiful opportunities for unusual returns with less than commensurate risk, and sometimes opportunities are few and risky. It’s important to wait for the former. When there’s nothing clever to do, it’s a mistake to try to be clever.”

– Howard Marks

As it relates to CRE and given where both bond yields are today and the potential returns for certain undervalued equities over the next 2-4 years (I’m excluding basic index investing), CRE returns are going to have to adjust considerably to attract WC back to the risk and illiquidity of the CRE asset class. For some investors, annual returns in the low to mid-teens in CRE are acceptable. While I respect differing risk profiles and return parameters amongst investors, this level of returns is not currently attractive to WC. I’d suggest that if you can get similar returns in certain equities within the same time frame and without any leverage, why would you want your capital in an illiquid asset class offering the same returns but likely with debt risk? One answer is diversification, which is certainly part of a defensible investing philosophy and especially so for nonprofessional investors. However, the lower the returns are with CRE, the less compensated an investor is for that investment risk and the increase in likelihood of a capital impairment. In comparison today, certain equities and bonds easily remain the more sensible mechanisms to defend and grow capital relatively speaking. Having said that, and with great respect for my fellow operators and colleagues who are out making new capital allocations today, I will concede that certain operators in the CRE space that have an “edge” in the market will perform well and perhaps offer satisfying returns that are justifiable given the inherent risks of CRE investing. For those operators that are part of “the herd” and doing the same things as everyone else is, outperformance is much less likely. Additionally, CRE values have decreased and could soon decrease further allowing for potentially increased future returns. There certainly is some distress present in CRE today which warrants being ready to pounce when an opportunity arises. If interest rates stay higher for longer, this will inevitably devalue CRE given how debt centric the asset class is. For those of you who are spreading capital around different disciplines and amongst multiple CRE operators, and with the caveat that any expectations shared here exclude the potential for a deep recession that changes the playing field and negatively affects asset performance, I’ll suggest a few promising areas that might be worth your consideration that may produce acceptable returns for you.

“The entire secret to investing is to figure out what something is worth, and then pay a lot less for it.”

– Joel Greenblatt- “Richer, Wiser, Happier” by William Green

In CRE, the healthiest asset class is industrial – which is also one of the most capital crowded asset classes. Although there is general stability with industrial rental rates, demand has recently cooled, and a lot of supply is still arriving yet it’s likely that industrial will continue to generally remain healthy given the anticipated growth of on shoring manufacturing and additional distribution needs to serve the market as a result of de globalization. With rental rates already sky high after years of massive appreciation, imagining dramatically appreciating rental rates going forward seems to be a bit of a stretch near term although still possible in a few years after the current supply is absorbed and the market experiences a lull in new deliveries given the lack of capital available for new development today.

While there’s a debt problem in several cases that must play out with multi-family, this asset class should have generally healthy demand given demographics, the lack of supply of housing, and lack of affordability of single-family homes. This asset class is also crowded with substantial amounts of new capital looking to get involved and it’s more likely new capital will step in to recapitalize struggling assets before any mass wave of foreclosures occurs given that many troubled assets have relatively healthy occupancy and steady cash flow – and are only troubled due to poor debt capital management. Unlike with industrial, multi-family rental rates are generally flat and/or falling in some markets. The game of aggressive rental rate growth assumptions has ended for now. Given that new development across both industrial and multi- family has halted recently due to lender pullback from funding new construction, after the current under construction projects get delivered and absorbed, there’s going to be a lull in new supply in 2025-2026 that could bode very well for both asset classes and allow for rental rate increases if demand holds up. There’s a good demand story here for both AND plenty of capital competition chasing these asset classes too. I tend not to be attracted to such crowded capital markets when purchasing but of course adore those conditions when selling assets.

Single family residential for sale and single-family build to rent (BTR) will perform well as long as it’s the correct product, in the correct location, and at the correct price point. Simply given the lack of supply and expected demand from millennials who are starting families and aging into a new season of life, there should be good velocity of sales in general and perhaps better demand for BTR homes than for traditional rental apartments. Once children enter the picture, the desire for a house with a yard and a pet tends to garner more interest than the apartment complex with the cool coffee shop down the street. For those who can’t afford to buy, they will migrate towards BTR which continues to emerge as a legitimate and growing asset class. Wall Street investors considering acquisitions in the BTR space are now struggling to meet their return hurdles in some cases with both homes and debt capital now being more costly. While there is plenty of capital available to fund new construction, many capital sources are less aggressive in purchasing existing new BTR neighborhoods today. There is also noise of potential federal legislation that would limit Wall Street capital from owning BTR single-family homes which is something to keep an eye on if you are planning to exit a BTR asset with an asset sale to a Wall Street capital source. Another potential governor on returns of for sale product is the cost of construction and the cost of land coupled with the already historically high cost of new homes which may limit how much higher prices can rise and still be feasible for buyers- if land prices and constructions costs remain firm or increasing, a ceiling on returns is possible when the cost of home ownership is already astronomically high in every possible way.

Office is a totally different animal with a secular change in demand patterns. The newest, best, and brightest projects and/or those in the “best” locations and with modernized amenities have performed generally well since the pandemic; and then there’s everybody else with varying degrees of problems. Many older assets with limited amenities will eventually have to be repurposed if feasible or otherwise bulldozed. For those that are unfortunate enough to have capital risk in these outdated commodity projects, losses are likely unavoidable for most (although there will be a few conversions to medical or residential use that make sense). Underwriting the lease up of commodity office today is a blind guessing game as nobody really wants those assets due to inability to assess potential future demand and the associated expensive leasing costs; plus, most current owners and lenders can hardly afford to sell them at anything near their true worth. It’s a pretty bleak situation for commodity office which also means the best bargains will be in distressed office assets offering outsized returns for those who can navigate through a successful leasing process. There will also be some scenarios where no price is low enough to justify the risks and the challenges with future leasing and some naive investors will make poor leasing assumptions that are too ambitious and be left to catch falling knives. There will be many zombie office projects that limp along with moderate occupancy while owners and lenders endlessly brainstorm on how to unlock their capital in these headache assets. It’s going to be a long and arduous journey for many in the office arena.

Retail vacancies are currently at 5.3%, the lowest level since 2007. The consensus in retail is that if you’ve made it this far, you’ve probably got a property that in most cases has enough inherently good traits to maintain prospective tenant interest that will support ongoing occupancy (with the exception being Class B and C malls and then some urban retail that is predominantly reliant on workers returning to the office).

Senior housing was hurt during the pandemic but has survived and is recovering. Demographics for this asset class look generally quite favorable going forward. I tend to believe there is a good runway for senior housing and the best operators are going to thrive in a market with steady demand if they can contain growing operational costs somehow. Inflation has done this asset class no favors and especially from a labor perspective for the full-service senior housing projects.

With all these varying asset classes and others, land prices and construction costs will be challenging with adding new supply and with rental rates already very high in general creating affordability challenges for everyone.

SUMMARY

“As a rule, panics do not destroy capital; they merely reveal the extent to which it has previously been destroyed by it’s betrayal into hopelessly unproductive works.”

-John Mills- Credit Cycles and the Origin of Commercial Panics- 1867

After almost 3 decades in the CRE business, I must confess that I have probably as little clarity about what direction the CRE market is going to take in the near term as I ever have. CRE owners can try to push their problems into the future and kick the can down the road – and if the banks and their regulators are in alignment on the path forward, this works temporarily; but I don’t see how capital losses can be completely dodged and eventually some will have to be incurred. I would guess that the CRE markets will continue to generally be slow while the ramifications of higher interest rates percolate through the economy and the lag effect of the increased cost of capital unfolds. Since 2020, so much has happened in the world in such a short period of time and has included a very high level of capital distortion, government intervention, and drama. What will ultimately be the aftermath of the lifestyle distortions due to the pandemic, the era of low interest rates and “free money”, excessive fiscal stimulus our government has delivered into the market, ongoing inflation risks, political dysfunction in Washington D.C., economic and tax policy, and the geopolitical risks facing the U.S. today? How will economic conditions hold up through all these various circumstances? The road ahead looks bumpy and with a lot of volatility. How these and many other important variables affect overall economic conditions will certainly drive CRE performance.

“Politics is the art of achieving power and prestige without merit.”

– P.J. O’Rourke

Regarding the 2024 Presidential election, all I’ll say is my expectation is that regardless of the election results, most of us will likely be disappointed with whatever the next four years will be like politically and I’m eager to get to the other side of whatever political era we are in today. Hope springs eternal and I’ll hope for the best and be prepared for the worst. Thank you for your partnership and trust with your capital and I’ll call if I see anything worth pursuing. I wish all of you a happy and healthy spring season and best wishes in 2024.

Sincerely,

Harold

Investor Letter 2024 (PDF for Download)